When you’re buying a home, understanding home loan interest rates is one of the most crucial aspects of the process. Your interest rate directly influences your monthly payments, the overall cost of your mortgage, and your long-term financial situation. Whether you’re a first-time homebuyer or looking to refinance your existing home, the interest rate on your loan can make a significant difference.

In this article, we’ll explore the truth about home loan interest rates. We’ll dive deep into how they are determined, what factors influence them, and how you can secure the best rate for your home loan. Along with expert insights, we’ll answer some common questions to ensure that you fully understand what home loan interest rates mean for your financial future.

Key Takeaway

The interest rate on your home loan is a critical factor in determining the overall cost of your mortgage. By understanding the factors that influence rates, shopping around for lenders, and improving your credit score, you can secure the best rate possible and save money over the life of your loan. Don’t rush the process—take your time, compare offers, and make informed decisions to get the best deal for your future.

What Are Home Loan Interest Rates?

Before we get into the specifics, let’s clarify what home loan interest rates actually are. Simply put, your interest rate is the percentage of the loan amount you will pay to the lender in addition to the principal. The rate is typically expressed as an annual percentage rate (APR) and is applied to the amount of money you owe to the lender.

For example, if you borrow $200,000 with a 4% interest rate, you will pay 4% of $200,000 annually as interest, in addition to repaying the $200,000 loan amount (the principal). The higher the interest rate, the more you will pay over the life of the loan.

Fixed vs. Adjustable Rate Mortgages

When it comes to home loan interest rates, one of the first decisions you’ll need to make is whether to opt for a fixed-rate mortgage (FRM) or an adjustable-rate mortgage (ARM).

Fixed-Rate Mortgages (FRM)

As the name suggests, fixed-rate mortgages have an interest rate that remains constant throughout the life of the loan. This type of loan offers stability and predictability because your monthly payments won’t change. This can be a good choice if you plan on staying in the home for a long time and want the security of knowing exactly how much you’ll pay every month.

Pros of Fixed-Rate Mortgages:

- Consistent monthly payments.

- Predictable long-term costs.

- Peace of mind if interest rates rise in the future.

Cons of Fixed-Rate Mortgages:

- Higher initial interest rates compared to ARMs.

- Less flexibility if you plan to sell or refinance within a few years.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages, on the other hand, have interest rates that can change over time. Typically, these loans offer a lower interest rate initially (often for 3, 5, 7, or 10 years) before adjusting according to the market. The interest rate will then fluctuate at regular intervals, depending on changes in an underlying index rate (such as LIBOR or the U.S. Treasury rate).

Pros of Adjustable-Rate Mortgages:

- Lower initial interest rates.

- Potential to save money if you sell or refinance before the rate adjusts.

- Greater flexibility for short-term homeowners.

Cons of Adjustable-Rate Mortgages:

- Uncertainty and risk of rising rates.

- Potential for increased payments if rates go up.

- More complex to understand than fixed-rate loans.

How Home Loan Interest Rates Are Determined

Home loan interest rates are not set by a single entity but are influenced by a variety of factors. Understanding these can help you make better decisions about when and where to apply for a mortgage.

The Federal Reserve and Economic Conditions

The U.S. Federal Reserve plays a major role in influencing interest rates, particularly through its control over the federal funds rate—the interest rate at which banks lend to one another. When the Federal Reserve raises or lowers this rate, it directly impacts the rates that lenders offer to consumers. For instance, when the Fed lowers interest rates to stimulate the economy, mortgage rates tend to decrease as well, making it cheaper for borrowers to take out loans.

Economic conditions also affect interest rates. During periods of inflation, the Fed may increase rates to control rising prices, while during times of economic uncertainty or recession, the Fed may lower rates to encourage borrowing and investment.

Your Credit Score

Your credit score is one of the most significant factors lenders use to determine your interest rate. Lenders view borrowers with higher credit scores as less risky, and therefore, they offer them lower interest rates. The typical credit score cutoff for obtaining favorable interest rates is around 700 or higher.

- Excellent Credit (740 and above): Typically, borrowers in this range receive the best possible rates.

- Good Credit (700 to 739): Borrowers with good credit can expect favorable rates, but slightly higher than those with excellent credit.

- Fair Credit (640 to 699): Borrowers may still be approved, but the rates offered will be higher than for those with good or excellent credit.

- Poor Credit (below 640): Borrowers may struggle to get approved for a loan and may face high interest rates if they do.

Improving your credit score by paying off debt and making timely payments can help you secure a better interest rate.

The Type of Loan You Choose

The type of loan you choose will also impact your interest rate. For example, conventional loans typically have higher interest rates than government-backed loans like FHA, VA, or USDA loans. However, these government loans often come with additional eligibility requirements, so you’ll need to assess your financial situation and determine which type of loan is best for you.

Loan Term and Loan Amount

Shorter loan terms typically come with lower interest rates because they are less risky for lenders. For example, a 15-year mortgage generally has a lower interest rate than a 30-year mortgage, as there is less time for the lender to be exposed to risk.

Additionally, the size of your loan may impact the interest rate you are offered. Larger loans, often referred to as “jumbo loans,” usually come with higher interest rates due to the increased risk for the lender.

Market Conditions and Inflation

Interest rates can also be affected by broader market conditions and inflation. If inflation is rising, lenders may increase rates to compensate for the decreased value of money. Conversely, if inflation is under control or the economy is slowing, lenders may reduce rates to stimulate borrowing and spending.

Tips to Secure the Best Home Loan Interest Rate

Securing the best home loan interest rate can save you thousands of dollars over the life of your loan. Here are some expert tips to help you secure the best rate possible:

Improve Your Credit Score

Since your credit score plays a significant role in determining your interest rate, take steps to improve it before applying for a loan. Pay off outstanding debts, dispute errors on your credit report, and avoid making large purchases or taking out new lines of credit before applying.

Shop Around for Lenders

Different lenders offer different rates, so it’s important to shop around and compare offers. Consider working with a mortgage broker who can help you navigate the different options and find the best deal. Additionally, don’t be afraid to negotiate with lenders to get better terms.

Make a Larger Down Payment

A larger down payment reduces the lender’s risk and can help you secure a lower interest rate. If possible, aim to put down at least 20%, as this will help you avoid private mortgage insurance (PMI) and may improve your chances of getting approved for a better rate.

Consider the Loan Type and Term

If you’re planning to stay in your home for a long time, a fixed-rate mortgage may be the best choice for stability and predictability. However, if you’re planning to sell or refinance within a few years, an adjustable-rate mortgage with a lower initial rate may be a good option. Keep in mind that the length of the loan term will also affect your rate, with shorter terms generally offering lower rates.

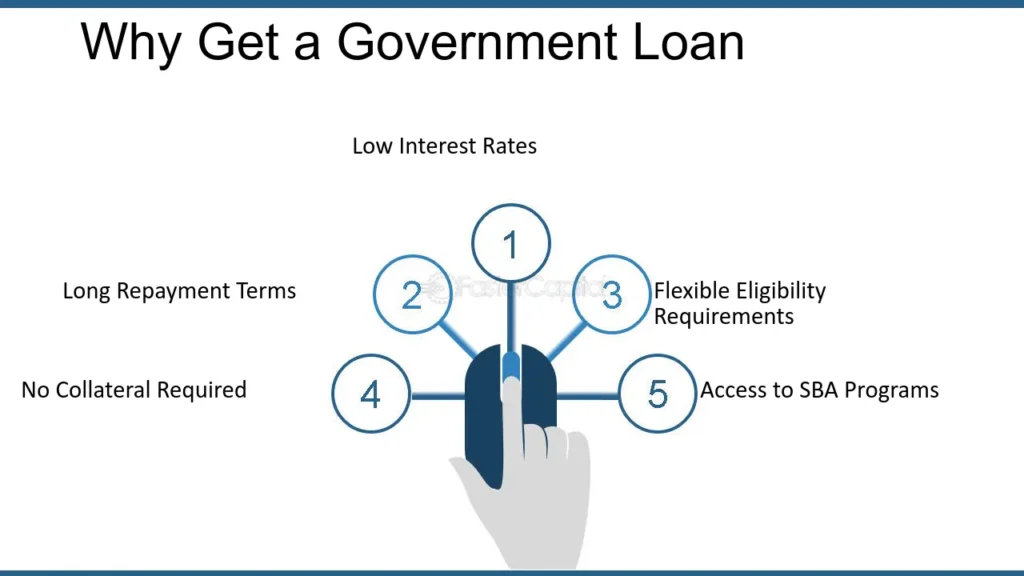

Exploring Government-Backed Home Loans: What Are Your Options?

Buying a home can be a daunting process, especially when it comes to securing a mortgage. For many potential homeowners, a government-backed home loan can be an excellent option to help achieve their dream of homeownership. These loans are supported by federal agencies to reduce the risk for lenders, which often leads to more favorable terms for borrowers. However, understanding the different types of government-backed home loans, their eligibility requirements, and the benefits they offer can be complex.

In this article, we’ll break down the most common government-backed home loans, explain who qualifies for them, and provide a comprehensive guide to help you determine which one might be the best fit for you.

What Are Government-Backed Home Loans?

Government-backed home loans are mortgages that are insured or guaranteed by the U.S. government. These loans are designed to make it easier for individuals to buy homes, especially those who may have less-than-perfect credit or limited financial resources. The backing from the government helps reduce the risk for lenders, which, in turn, allows them to offer better loan terms, such as lower interest rates, smaller down payments, and more flexible qualification criteria.

Government-backed loans can be divided into three main types: FHA loans, VA loans, and USDA loans. Each of these loan types is backed by a different federal agency and has its own set of qualifications and advantages.

FHA Loans: Federal Housing Administration Loans

The Federal Housing Administration (FHA) is a government agency that insures mortgages made by approved lenders to borrowers with low to moderate incomes. FHA loans are designed to help first-time homebuyers or those with less-than-perfect credit get approved for a mortgage. The FHA insures the loan, which means that if the borrower defaults, the lender is protected.

Key Features of FHA Loans:

- Low Down Payment: FHA loans require as little as 3.5% down if your credit score is 580 or higher. For borrowers with credit scores between 500 and 579, the down payment requirement increases to 10%.

- Lower Credit Score Requirements: FHA loans are often more lenient when it comes to credit score. With a credit score of 580 or higher, you can qualify for the 3.5% down payment. If your credit score is lower, you may still qualify with a larger down payment.

- Mortgage Insurance Premium (MIP): FHA loans require both an upfront MIP (typically 1.75% of the loan amount) and an annual MIP. This cost is added to your monthly payments, which can increase the overall cost of the loan.

- Flexible Debt-to-Income (DTI) Ratios: FHA loans are more forgiving when it comes to debt-to-income ratios, which is helpful for borrowers with existing debt.

Who Should Consider FHA Loans?

FHA loans are ideal for:

- First-time homebuyers

- Those with lower credit scores

- Borrowers who may not have a large down payment saved up

VA Loans: U.S. Department of Veterans Affairs Loans

VA loans are home loans backed by the U.S. Department of Veterans Affairs (VA), specifically for veterans, active-duty service members, and some surviving spouses. The goal of a VA loan is to help those who have served or are currently serving in the U.S. military buy homes with favorable terms.

Key Features of VA Loans:

- No Down Payment Required: One of the most attractive features of VA loans is that they often require no down payment. This can be a significant advantage for military personnel and veterans who may have limited savings.

- No Private Mortgage Insurance (PMI): Unlike other loan types that require PMI if the down payment is less than 20%, VA loans do not require PMI, which can lower monthly payments.

- Competitive Interest Rates: VA loans typically offer lower interest rates compared to conventional loans, which can help borrowers save money over the life of the loan.

- Lenient Credit Requirements: While there is no minimum credit score requirement for VA loans, most lenders prefer a score of 620 or higher. The VA also considers your overall financial situation rather than focusing solely on your credit score.

- Funding Fee: While VA loans do not require PMI, they do require a one-time funding fee (typically between 1.25% and 3.3% of the loan amount), which helps offset the cost of the loan program. This fee can be rolled into the loan amount.

Who Should Consider VA Loans?

VA loans are ideal for:

- Veterans and active-duty military personnel

- Surviving spouses of veterans

- Those who have served in the U.S. armed forces

USDA Loans: U.S. Department of Agriculture Loans

USDA loans are backed by the U.S. Department of Agriculture (USDA) and are intended for low- to moderate-income borrowers in rural and suburban areas. These loans are designed to promote homeownership in less densely populated regions of the U.S. and are especially useful for people who may not qualify for traditional loans due to income restrictions or a lack of down payment.

Key Features of USDA Loans:

- No Down Payment: USDA loans allow eligible borrowers to purchase a home with no down payment, which can significantly reduce the upfront costs of buying a home.

- Income Limits: To qualify for a USDA loan, your household income must not exceed 115% of the median income for the area where you plan to buy. The income limit varies depending on the location and family size.

- Lower Mortgage Insurance Costs: USDA loans require two types of mortgage insurance: an upfront guarantee fee (typically 1% of the loan amount) and an annual fee that is paid monthly (typically 0.35% of the loan amount). These fees are usually lower than the mortgage insurance premiums associated with FHA loans.

- Low Interest Rates: USDA loans often come with competitive interest rates, which can help lower your monthly payments.

Who Should Consider USDA Loans?

USDA loans are ideal for:

- Homebuyers purchasing in rural or suburban areas

- Borrowers with low-to-moderate incomes

- Those who are unable to afford a large down payment

How to Qualify for a Government-Backed Loan

While each government-backed loan has its own set of eligibility requirements, there are some general qualifications that apply across all types of loans:

FHA Loan Eligibility:

- Credit Score: Minimum score of 500-580, depending on the down payment.

- Down Payment: Minimum of 3.5% if credit score is 580 or higher.

- Debt-to-Income Ratio: Generally, FHA loans allow a higher DTI ratio than conventional loans (up to 43% in many cases).

VA Loan Eligibility:

- Service Requirements: You must be an active-duty service member, a veteran, or a surviving spouse of a deceased veteran.

- Length of Service: Typically, you must have served at least 90 consecutive days of active service during wartime or 181 days of active service during peacetime.

USDA Loan Eligibility:

- Location: The property must be located in a USDA-approved rural or suburban area.

- Income Requirements: Household income must not exceed 115% of the median income for the area.

- Credit Score: While USDA loans don’t have a strict minimum credit score requirement, most lenders prefer a score of at least 640.

Benefits of Government-Backed Loans

- Lower Down Payments: Government-backed loans typically require much smaller down payments compared to conventional loans, making them more accessible for first-time buyers or those with limited savings.

- Lower Interest Rates: These loans often come with lower interest rates than traditional mortgages, which can result in significant savings over the life of the loan.

- Easier Qualification Requirements: Government-backed loans have more lenient credit score and debt-to-income ratio requirements, allowing those with less-than-perfect credit or higher levels of debt to still qualify for a mortgage.

- No PMI on Some Loans: Both VA and USDA loans do not require private mortgage insurance (PMI), which can reduce monthly payments for borrowers.

Also Read: Navigating The Home Loan Process: A Complete Guide For First Time Buyers

Conclusion

Understanding home loan interest rates is essential to making smart financial decisions when buying a home. By knowing what factors influence interest rates and how you can improve your chances of securing a good rate, you can save yourself thousands of dollars over the life of your loan.

Whether you opt for a fixed-rate mortgage or an adjustable-rate mortgage, make sure to do your research, shop around for the best deals, and consider your long-term goals. With the right knowledge and preparation, you’ll be well on your way to securing the home loan that works best for you.

FAQs

What is a good interest rate for a mortgage?

A good mortgage interest rate depends on various factors, including your credit score, the type of loan, and current market conditions. Generally, a rate of around 3-4% for a 30-year fixed-rate mortgage is considered good, though rates fluctuate over time.

How can I lower my interest rate on a mortgage?

To lower your interest rate, work on improving your credit score, save for a larger down payment, and consider shopping around for the best deal from multiple lenders.

Why do interest rates change?

Interest rates change due to economic factors, inflation, and the Federal Reserve’s monetary policy decisions. Lenders adjust their rates based on these conditions to balance risk and reward.

Can I negotiate my interest rate?

Yes, you can negotiate your interest rate, especially if you have a good credit score and a strong financial profile. Lenders may be willing to offer a better rate to secure your business.

Should I choose a fixed-rate or adjustable-rate mortgage?

It depends on your plans and financial situation. A fixed-rate mortgage offers stability, while an adjustable-rate mortgage may offer a lower initial rate but can fluctuate over time.

What is APR, and how is it different from the interest rate?

APR (annual percentage rate) includes the interest rate along with additional fees, such as closing costs and loan origination fees. It provides a more comprehensive picture of the loan’s true cost.

How do I know if I’m getting a good deal on a mortgage rate?

To determine if you’re getting a good deal, compare the rates and terms from multiple lenders. Consider factors like your credit score, the loan type, and your long-term plans to ensure the mortgage meets your needs.